Industry Use Case – Cloud Architectures in Fintech

Get your team started in minutes

Sign up with your work email for seamless collaboration.

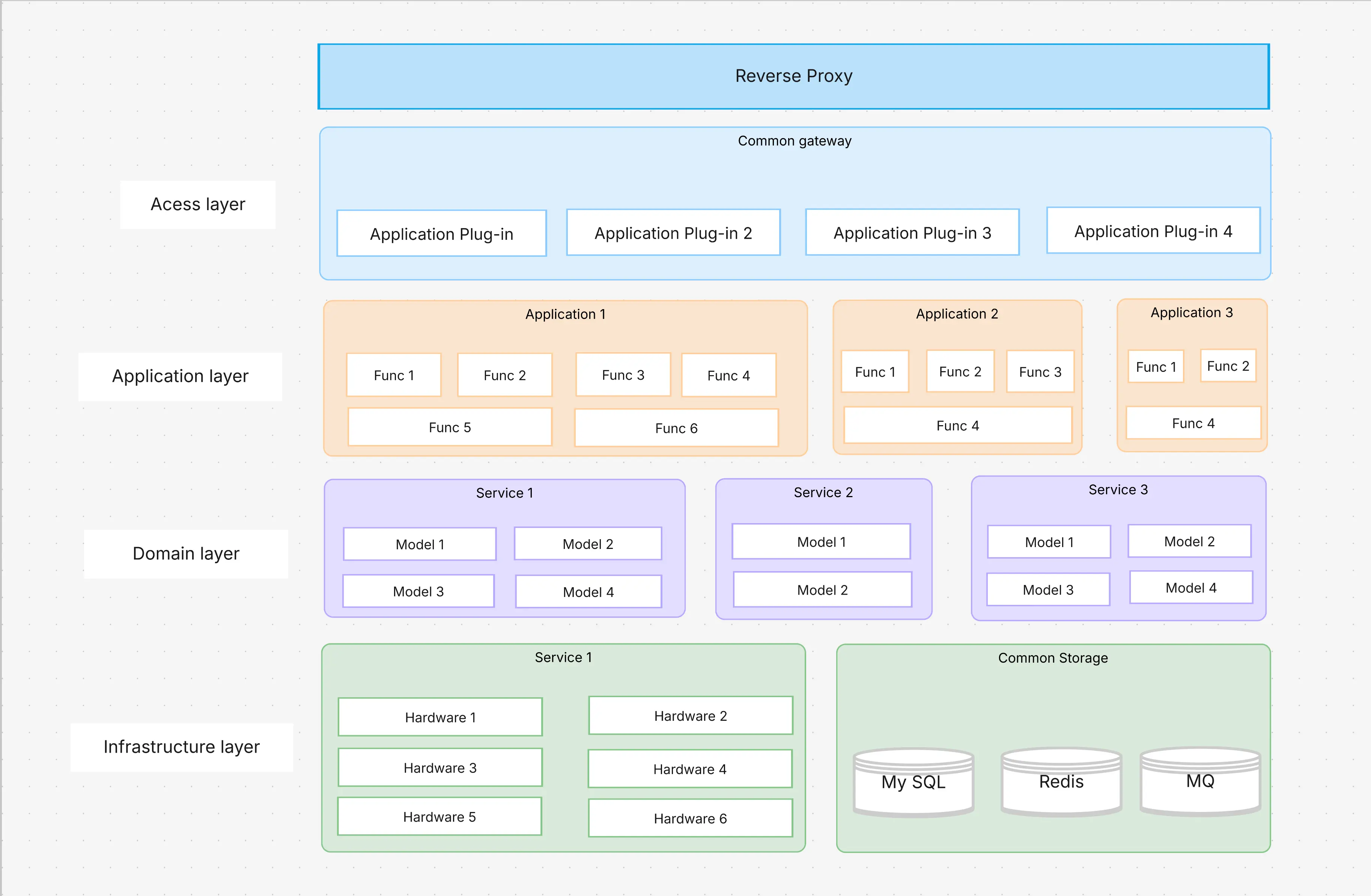

The financial technology (fintech) industry really depends on speed, tough security, and genuine customer trust. As customer demands continue evolving steadily, many traditional banks genuinely find it challenging to keep pace in real operations, leading fintech companies to adopt modern cloud application frameworks more aggressively. By moving confidently in this direction, fintechs genuinely gain the ability to manage massive transaction volumes, bring unique innovative solutions to market rapidly, and maintain strict compliance with complex regulations all while carefully controlling their overall costs.

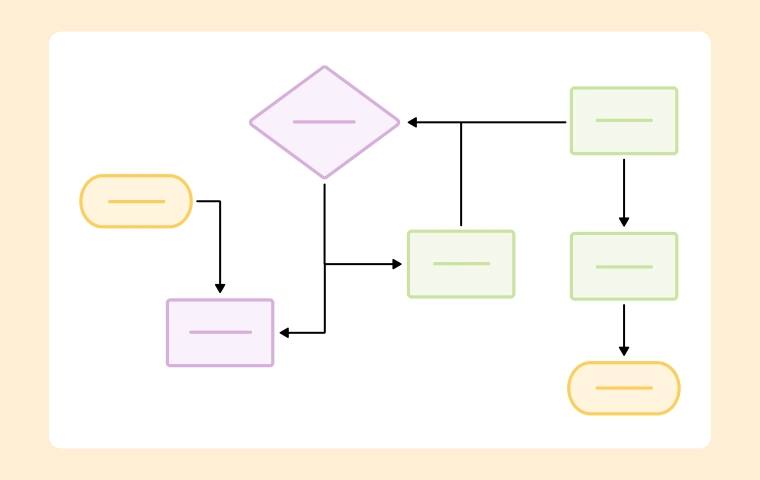

A fintech system isn’t just about moving everything to the cloud. It works best when scalability, integration, and compliance come together in one design.

you can also use this Cloud System Architecture Template.

The fintech industry operates under some of the strictest compliance rules worldwide. A reliable cloud-based architecture has to put compliance at the center of its design, not treat it as an optional extra.

Forward-looking fintech companies adopt the cloud today because it provides smart capabilities that on-premises systems, in my experience, will never be able to match.

For ambitious fintechs today, cloud application architecture is more than just a smart technology choice it’s truly a lasting competitive advantage.

It powers growth, safeguards compliance, and creates customer trust. With Cloudairy’s Cloud Architecture Diagram Tool, fintech companies can design secure, compliant, and scalable systems tailored to their needs.

Start using Cloudairy to design diagrams, documents, and workflows instantly. Harness AI to brainstorm, plan, and build—all in one platform.

.webp)

.webp)